Suppliers - 1099 Processing

January 8, 2025

- Prior discussions have resulted in this item being taken over by David B and other resources.

- Some additional notes to aid in this process.

- Records need to be pulled from CHECKS and POSPCASH.

- POSPCASH will hold payments made as cash for Jewelry Repairs.

- The report from MD Accounting comes from: *--Select * from GLGET_1099LIST ( MASTERBR , DMIN, DMAX , IEXCEPTID , IPETTY , INVALUE ) --IEXCEPTID 0: ALL , 1: GENERIC NAME ONLY, 2:VENDOR, 3:EMPLOYEE --IPETTY : 0:INCLUDED 1:EXCLUDED 2:ONLY *glget_1099list ( '00' , '01/01/2020', '12/31/2025' ,0,0,0.0);

- The source for this procedure is at O:\MISGRP\Multidev\Implementation Documentation\GLGET_1099LIST.procedure_source.txt

- A VERY SIMPLE join of records in CHECKS and POSPCASH is at O:\MISGRP\Multidev\Implementation Documentation\Reporting for 1099.txt

- Creating AMS output is likely best accomplished by a select based upon the Multidev procedures and selects in Reporting for 1099.txt. December 27, 2024

- Payments that require reporting on a 1099 form are drawn from the CHECKS table.

- Payee information is taken from a table called DESTPRV.

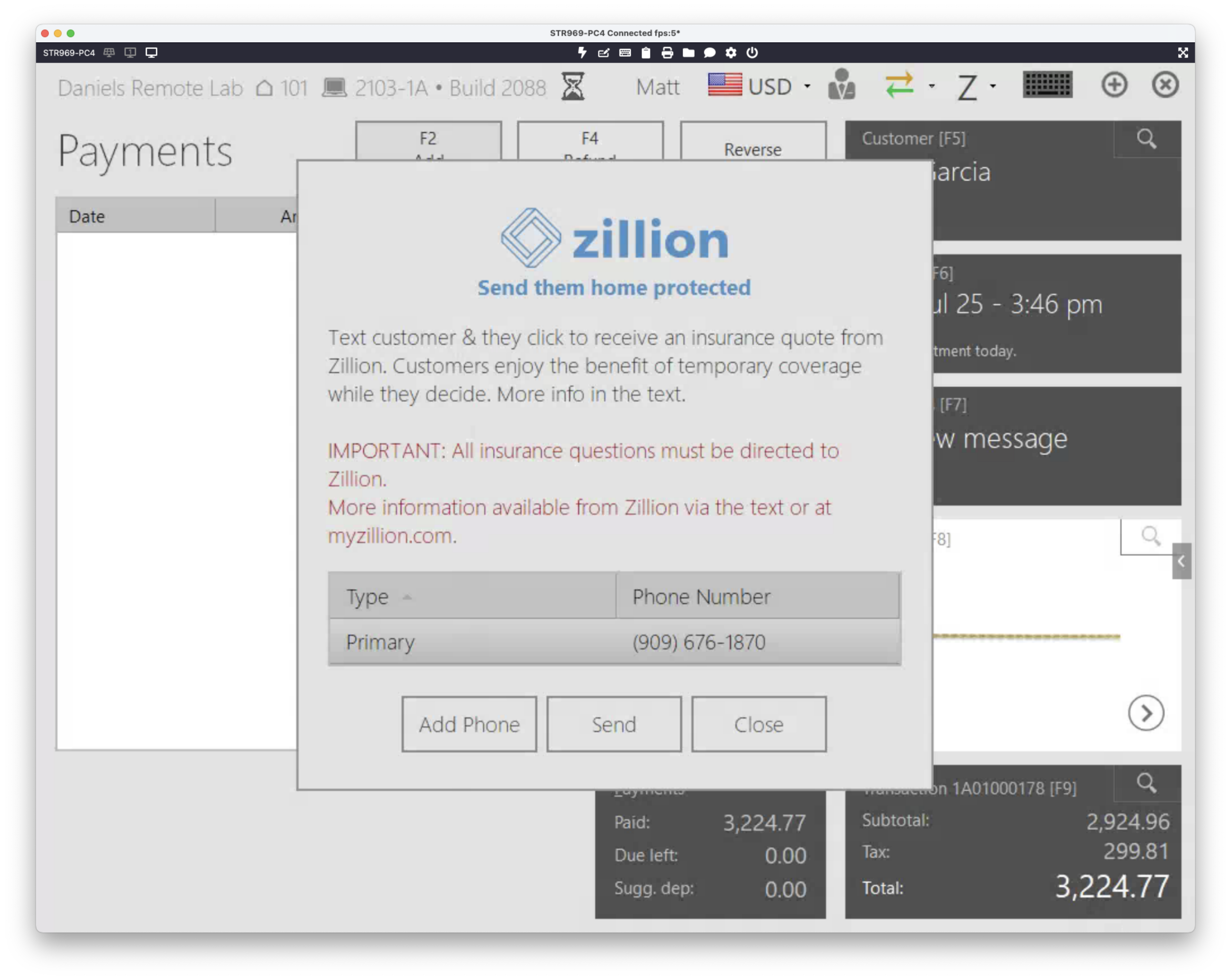

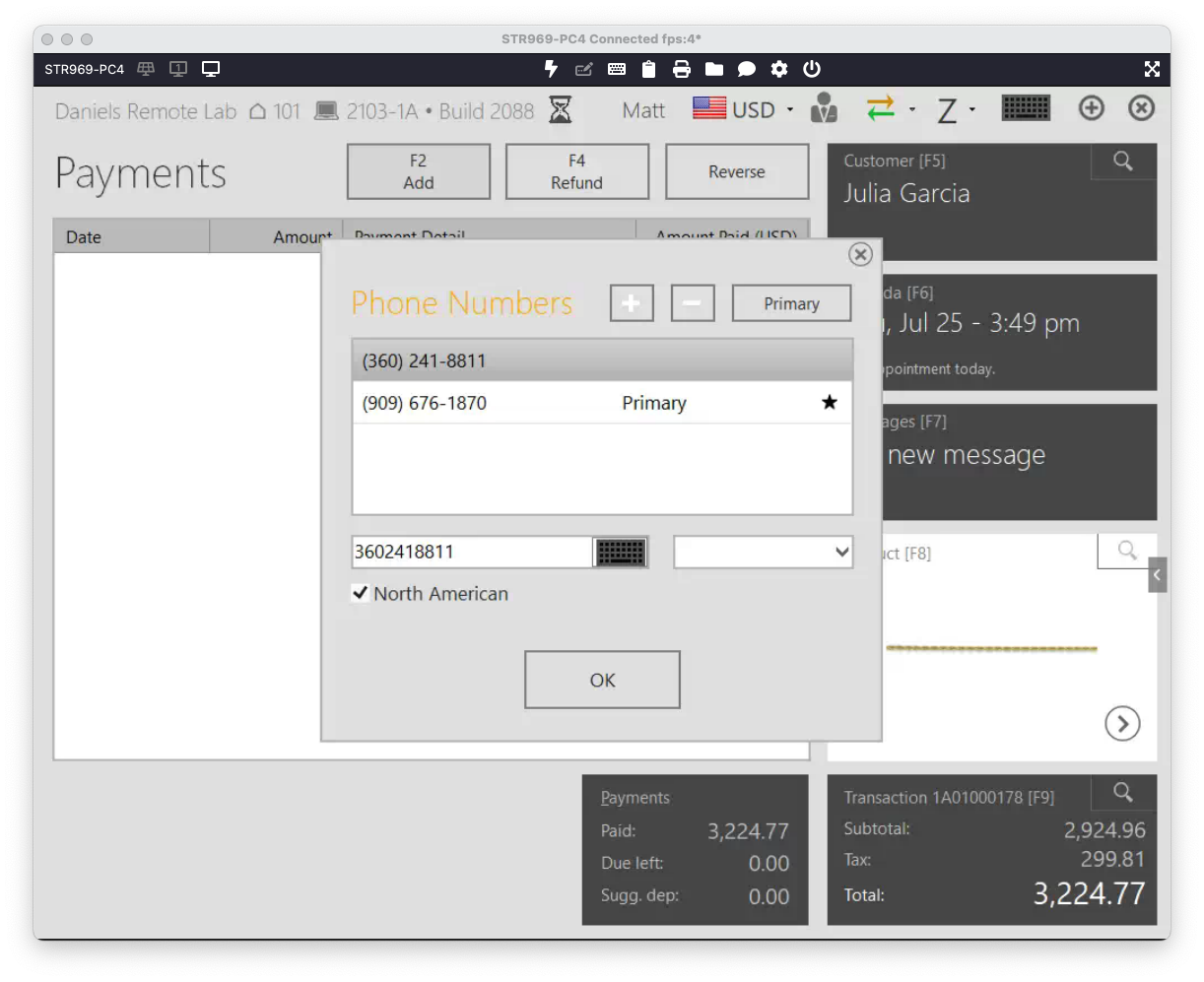

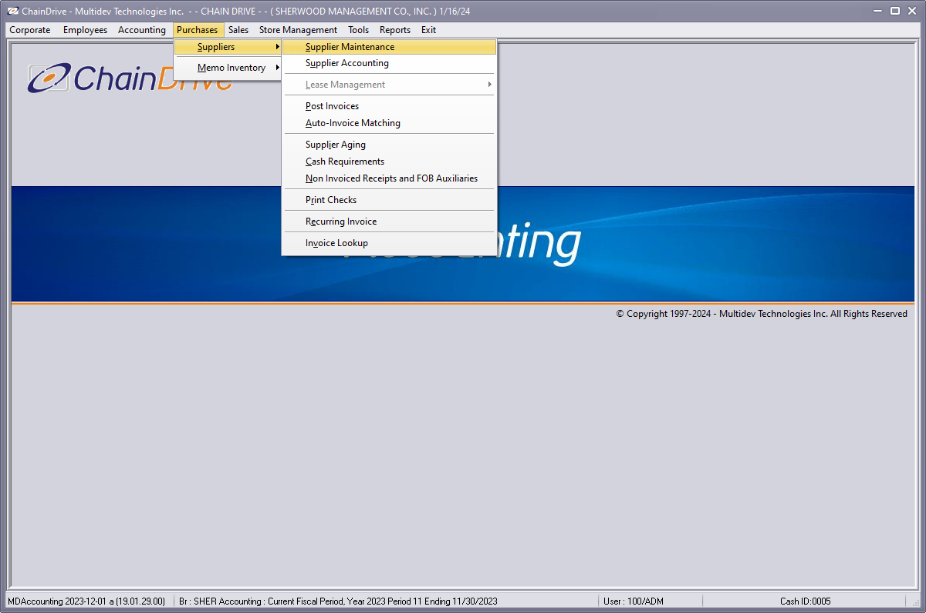

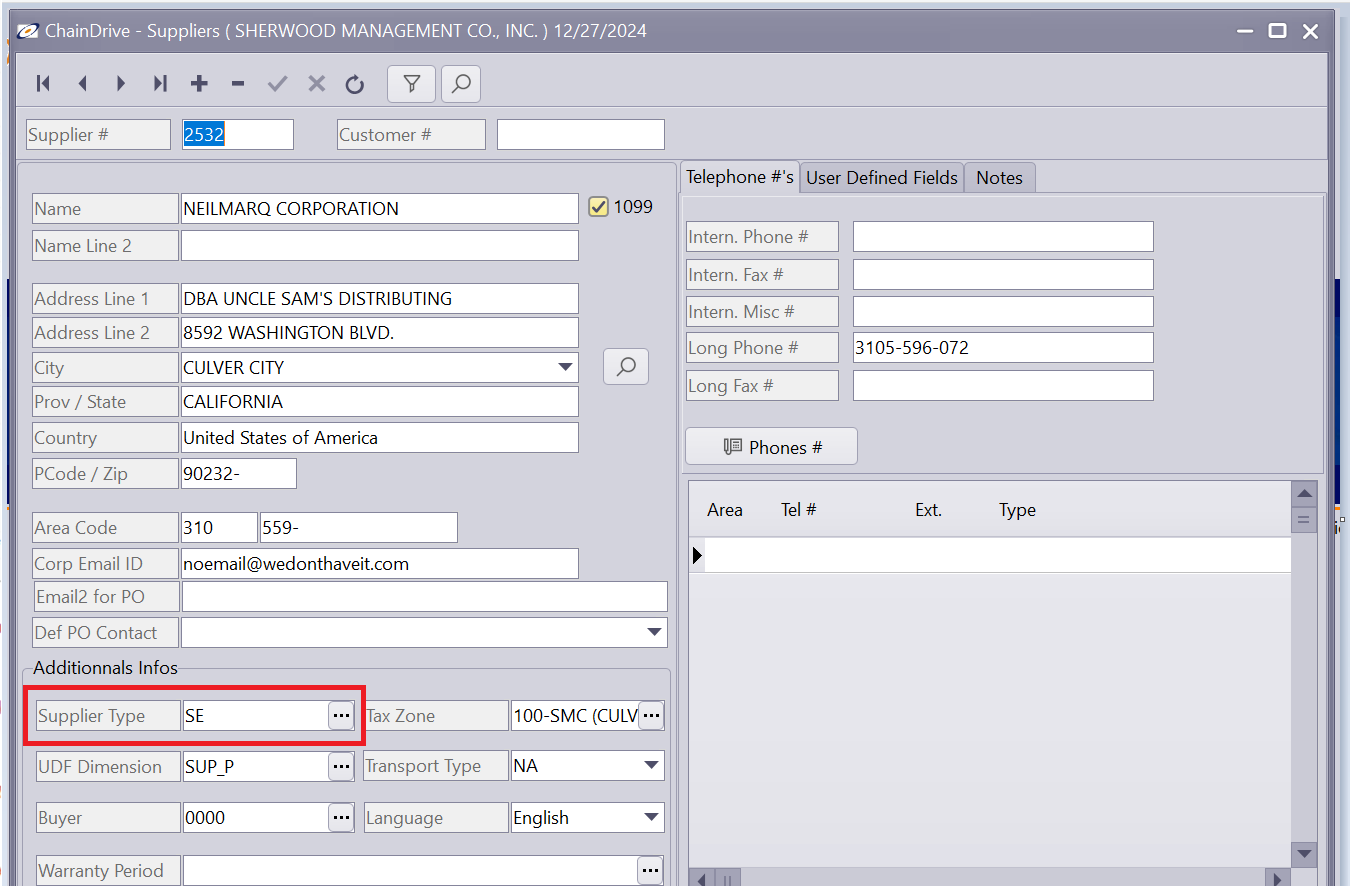

- The DESTPRV is automatically updated by records entered/updated in four different locations.

- SUPPLIERS

- EMPLOYEE

- CUSTOMERS

- payment type

- A 1099 flag and the associated TIN number are stored on the DESPTRV table.

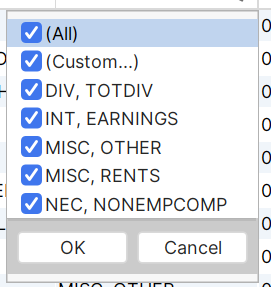

- IN -interest

- 1099 – INT

- DV - dividend

- 1099 – DIV

- NE – non-employee

- 1099 – NEC

- All others not IN, DV and NE, including

SE – Service

RP – Repair vendors

LL – Landords

- 1099 – MISC

- Regardless of vendor type, exports for 1099’s will be made ALWAYS is the 1099 flag is checked and ONLY if the 1099 flag is checked.

- “Out of the Multideve Box”

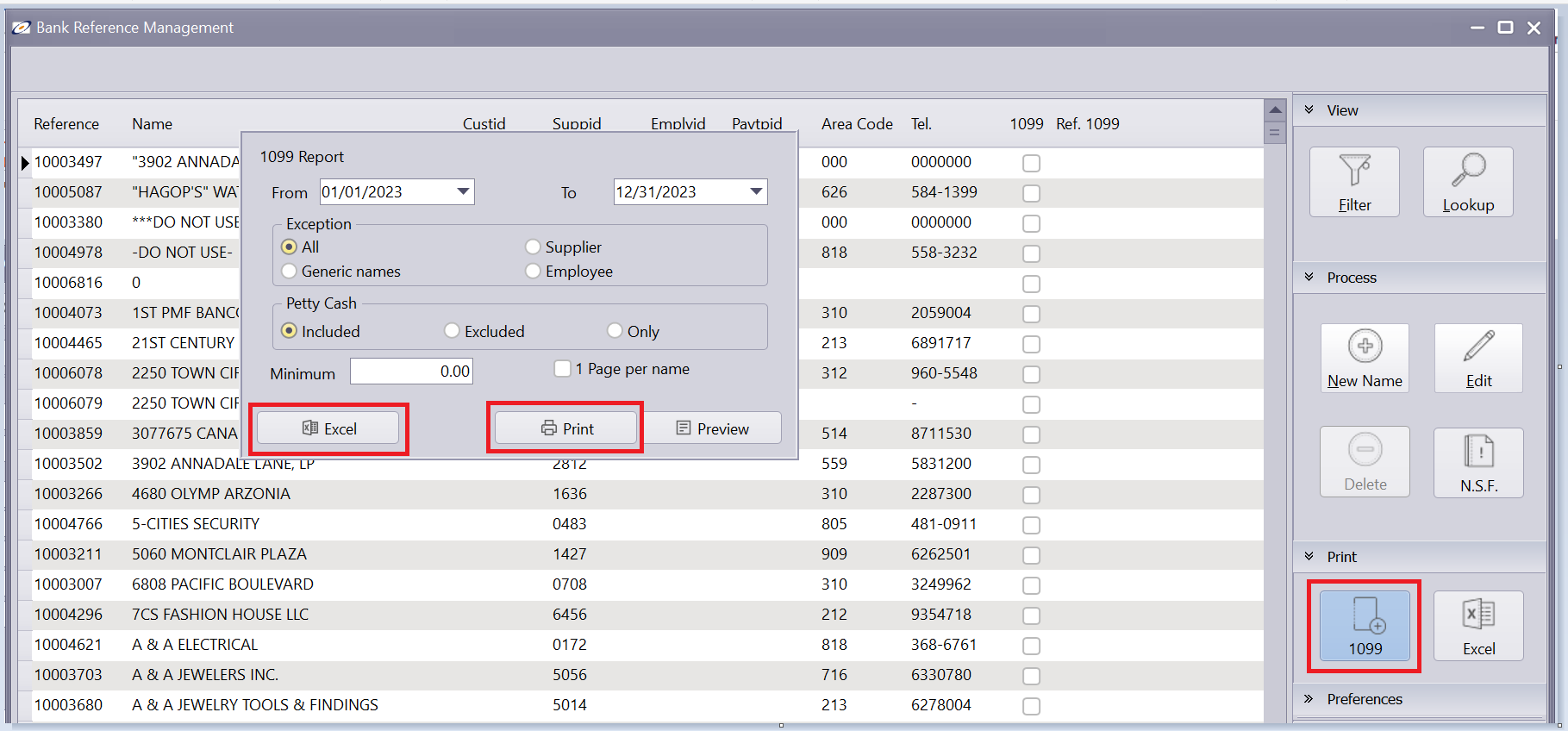

- The Excel and print output, however, is by check written. Which may be appropriate for proofing purposes but cannot be used directly with the 1099 production software we use – Advanced Micro Solutions (AMS).

- SMC Implementation Issues

- Data conversion

- AP.VEND.TYPE.CD

- In Universe, AP.VEND.TYPE.CD is used for supplier type.

- AP.VEND.CD has been updated to have the correct Multidev SUPPTYPE.

- See: O:\ACCTGRP\InformerLinks\Multidev\CODES - AP.VEND.TYPE.CD MD SUPPTYPE.iqy

- This table will show the Universe AP.VEND.TYPE.CD and the MD SUPPTYPE that it will be translated to.

- This table also shows the usage of MD SUPPTYPE for 1099 purposes.

- Changes to:

- VEND.MST AP.VEND.TYPE.CD should be made in Universe until final data conversion is done.

- The mapping of AP.VEND.TYPE.CD to MD SUPPTYPE should be done in the codes file (MA010).

- NOTE: MD SUPPTYPE DESCRIPTION 2 (1099 form to be used) is informational only. Changing them will not change how the 1099’s are output without changing the extract. See notes below for 1099 form extractions.

- 1099 Flags and TINs

- VEND.MST AP.1099.CD (1099 flag) and TIN.NO will be updated in Multidev (DESTPRV per vendor) as part of data conversion.

- Changes to VEND.MST AP.1099.CD (1099 flag) and TIN.NO should be made in Universe until final data conversion is done.

- AP.VEND.TYPE.CD

- Data Proofing

- Missing TIN

- AP903 in Universe current proofs for AP.1099.CD being set and no TIN on file.

- Multidev extract to be written:

- DESTPRV.FLG1099 is not null and DESTPRV.REF1099 is null

- Columns to be output to facilitate review/proofing.

- 1099 Amount

- AP903 in Universe currently proofs based upon on VEND.MST YTD.PAID and VEND.MST OVERRIDE.1099.AMT.

- The data structure in Multidev is such that detail and totals can be exported and records manually inserted or updated.

- Multidev extract to be written:

- From CHECKS, for time range (calendar year), join to DESTPREV by DESTPRVID where DESTPRVID = “Y”

- TO BE DETERMINED if each check should be output allowing for an EXCEL pivot to summarize, or single/second extract that already summarized.

- Columns to be output to facilitate review/proofing, including indication of 1099 Type (join SUPPTYPE.DESCRIPTION_2)

- From CHECKS, for time range (calendar year), join to DESTPREV by DESTPRVID where DESTPRVID = “Y”

- Missing TIN

- Output for AMS

- See O:\MISGRP\Multidev\Implementation Documentation\AMS 1099 Output.pdf

- Per David B, the number of 1099-INT, 1099-NEC and 1099-DIV forms to be filed is small.

- Formatting the extract for the AMS software may not be necessary for these form types.

- However, separate, “simple” extracts need to be built to support the manual input of these forms into the AMS software.

- Data conversion

- The extract for 1099-MISC has to be built correctly so that output the column RENTS is correct for SUPPTYPE LL (landlords).